In 2032 I expect the US government to be the largest holder and or miner of Bitcoin in the world. I guess there is a 50/50 chance I am either right or wrong.

Bitcoin | Blockchain | Cryptocurrency | Digital Asset/Capital/Credit | ... @BBCDSatoshi ...

Tuesday, July 30, 2024

Strategic Bitcoin Reserve announced 4 years early

In 2032 I expect the US government to be the largest holder and or miner of Bitcoin in the world. I guess there is a 50/50 chance I am either right or wrong.

Monday, July 29, 2024

7 / 8 months into 2024 (Halving, Bitcoin ETF, FTX Sam Bankman-Fried, and Craig Wright is not Satoshi Nakamoto, Changpeng Zhao (CZ), Roger Ver (Bitcoin Jesus), Ethereum ETF, Mt. Gox repayments, Donald Trump speaks at Bitcoin Conference 2024 Strategic Reserve)

7 / 8 months into 2024 and already these major events have happened:

1. The Bitcoin Halving (reducing supply from 6.25 to 3.125 BTC)

2. The Bitcoin ETF approval in the USA (by the SEC)

3. Sam Bankman-Fried imprisonment (FTX)

4. Craig Wright is not Satoshi Nakamoto (UK judge)

5. Changpeng Zhao (CZ) from Binance sentenced to 4 months in prison (USA)

6. Roger Ver (Bitcoin Jesus) charged with mail fraud and tax evasion, arrested in Spain

7. Ethereum ETF approval in the USA (by the SEC)

8. Mt. Gox begins paying creditors after a decade

9. Donald Trump speaks at Bitcoin Conference 2024 Nashville announces Bitcoin Strategic Reserve

Ready for the next 4 / 5 months of 2024?...

Monday, June 24, 2024

Twitter / X List: Started a simple list of people to follow, focused on the "Bitcoin Log-Log Power Law"

- Bitcoin Log-Log Power Law

- Resources, information and ideas based on the Bitcoin Log-Log Power Law

- https://twitter.com/i/lists/1805174747677728774

Friday, June 21, 2024

Bitcoin Improvement Proposal 3 (BIP): Utilization of a Fraction of Bitcoin’s Computing Power for Ransomware Decryption Assistance

Please note, this was written with the help of ChatGPT:

Title: Utilization of a Fraction of Bitcoin’s Computing Power for Ransomware Decryption Assistance

Author: BBCD Satoshi

Status: Draft

Type: Informational BIP

Created: 21 June 2024

Abstract: This proposal suggests the allocation of a small percentage (ranging from 0.01% to 1%) of Bitcoin’s total computing power to assist in efforts to decrypt or mitigate ransomware attacks. This initiative aims to leverage the vast computational resources of the Bitcoin network to support cybersecurity efforts, enhancing the overall security landscape.

Motivation: Ransomware attacks pose a significant threat to individuals, businesses, and public institutions, often leading to substantial financial and data losses. The Bitcoin network’s immense computational power can be partially redirected to assist in decryption efforts, providing a valuable tool in combating ransomware and enhancing public trust in the cryptocurrency ecosystem.

Specification:

Allocation: A designated percentage (between 0.01% and 1%) of the total hash rate of the Bitcoin network will be utilized for decryption efforts.

Mechanism:

- A system will be developed to temporarily divert a portion of mining power to work on decryption tasks related to active ransomware attacks.

- Participation will be voluntary, with miners opting in to contribute their computational resources to the decryption pool.

Governance:

- A decentralized committee or organization will be established to oversee the allocation and ensure the fair and transparent use of computing power.

- The community will be consulted to determine the specific criteria and processes for identifying and responding to ransomware threats.

Impact on Mining: The proposal will ensure that the diversion of computing power does not significantly impact the overall security and operation of the Bitcoin network.

Rationale: By contributing a fraction of its computing power, the Bitcoin network can play a proactive role in addressing a critical cybersecurity challenge. This initiative can improve Bitcoin’s public image, demonstrating its potential to provide societal benefits beyond financial transactions.

Backwards Compatibility: This proposal does not affect the Bitcoin protocol itself and is compatible with existing mining operations. Participation is optional, ensuring no adverse impact on miners who choose not to participate.

Implementation:

- Development: Create the necessary software and infrastructure to facilitate the redirection of computing power.

- Testing: Conduct extensive testing to ensure the system’s security, efficiency, and minimal impact on regular mining activities.

- Deployment: Roll out the system in phases, starting with a pilot program involving volunteer miners.

Bitcoin Improvement Proposal 2 (BIP): Allocation of Bitcoin’s Computing Power for Health and Medical Research

Please note, this was written with the help of ChatGPT:

Title: Allocation of Bitcoin’s Computing Power for Health and Medical Research

Author: BBCD Satoshi

Status: Draft

Type: Informational BIP

Created: 21 June 2024

Abstract: This proposal suggests donating a small percentage (ranging from 0.01% to 1%) of Bitcoin’s total computing power each month to assist in solving pressing health and medical challenges. The initiative aims to leverage the Bitcoin network’s computational resources to contribute to research efforts such as finding cures for diseases, developing new vaccines, and addressing urgent medical needs during pandemics.

Motivation: Health and medical research often require significant computational power for tasks like simulating biological processes, analyzing large datasets, and developing new treatments. The Bitcoin network, with its extensive computational capabilities, can provide valuable support to these research efforts. By allocating a portion of its hash rate, the Bitcoin community can contribute to global health advancements and demonstrate its commitment to societal well-being.

Specification:

Allocation: A designated percentage (between 0.01% and 1%) of the total hash rate of the Bitcoin network will be donated to medical research initiatives.

Mechanism:

- A system will be developed to temporarily redirect a portion of mining power to support computational tasks for health and medical research.

- Participation will be voluntary, with miners opting in to contribute their computational resources to the research pool.

Governance:

- A decentralized committee or organization will be established to oversee the allocation and ensure the fair and transparent use of computing power.

- The community will be consulted to determine the specific criteria and processes for selecting research projects and responding to medical emergencies.

Impact on Mining: The proposal will ensure that the diversion of computing power does not significantly impact the overall security and operation of the Bitcoin network.

Rationale: By donating a fraction of its computing power, the Bitcoin network can play a crucial role in advancing health and medical research. This initiative can improve Bitcoin’s public image, highlighting its potential to contribute positively to society and address critical global challenges.

Backwards Compatibility: This proposal does not affect the Bitcoin protocol itself and is compatible with existing mining operations. Participation is optional, ensuring no adverse impact on miners who choose not to participate.

Implementation:

- Development: Create the necessary software and infrastructure to facilitate the redirection of computing power.

- Testing: Conduct extensive testing to ensure the system’s security, efficiency, and minimal impact on regular mining activities.

- Deployment: Roll out the system in phases, starting with a pilot program involving volunteer miners.

Bitcoin Improvement Proposal 1 (BIP): Allocation of Bitcoin’s Computing Power for Ransomware

Please note, this was written with the help of ChatGPT:

Title: Allocation of Bitcoin’s Computing Power for Ransomware

Decryption Assistance

Author: BBCD Satoshi

Status: Draft

Type: Informational BIP

Created: 21 June 2024

Abstract: This proposal suggests allocating a small percentage (ranging from 0.01% to 1%) of Bitcoin’s total computing power to assist in decrypting ransomware attacks, particularly those where the ransom is demanded in Bitcoin. This initiative aims to leverage the Bitcoin network’s computational resources to combat ransomware, thereby improving the overall image of Bitcoin.

Motivation: Ransomware attacks represent a significant threat to individuals, businesses, and public institutions, often resulting in severe financial and data losses. Many of these attacks demand payment in Bitcoin, which can negatively affect the cryptocurrency’s reputation. By dedicating a portion of the Bitcoin network’s computing power to decryption efforts, the community can help mitigate these attacks and demonstrate Bitcoin’s potential to support cybersecurity initiatives.

Specification:

- Allocation: A designated percentage (between 0.01% and 1%) of the total hash rate of the Bitcoin network will be used for ransomware decryption efforts.

Mechanism:

- Develop a system to temporarily redirect a portion of mining power to work on decryption tasks associated with active ransomware attacks.

- Participation will be voluntary, allowing miners to opt-in and contribute their computational resources to the decryption pool.

Governance:

- Establish a decentralized committee or organization to oversee the allocation of resources and ensure fair and transparent use of computing power.

- Consult the community to define criteria and processes for identifying and responding to ransomware threats.

Impact on Mining:

- Ensure that the diversion of computing power does not significantly affect the overall security and operation of the Bitcoin network.

Rationale: By contributing a fraction of its computing power to ransomware decryption efforts, the Bitcoin network can actively participate in addressing a critical cybersecurity challenge. This initiative can enhance Bitcoin’s public image by showcasing its ability to provide societal benefits beyond financial transactions.

Backwards Compatibility: This proposal does not alter the Bitcoin protocol and is compatible with existing mining operations. Participation is optional, ensuring no adverse impact on miners who choose not to participate.

Implementation:

- Development: Create the necessary software and infrastructure to facilitate the redirection of computing power for decryption tasks.

- Testing: Conduct thorough testing to ensure the system’s security, efficiency, and minimal impact on regular mining activities.

- Deployment: Implement the system in phases, starting with a pilot program involving volunteer miners.

Thursday, May 30, 2024

When will Bitcoin be $1,000,000?

Screenshot from YouTube (https://www.youtube.com/watch?v=xL7aTmIrx6g) with Fred Krueger (@dotkrueger) and @apsk32 about the potential dates for Bitcoin reaching $1,000,000 sometime between July 2031 and July 2036

|

| [Bitcoin reaching $1,000,000 sometime between July 2031 and July 2036] |

Wednesday, May 8, 2024

Could this break the log/log power law for Bitcoin?

Tuesday, May 7, 2024

Hal Finney (Bitcoin) and Terry A. Davis (TempleOS)

Friday, May 3, 2024

5 months into 2024 (Halving, Bitcoin ETF, FTX Sam Bankman-Fried, and Craig Wright is not Satoshi Nakamoto, Changpeng Zhao (CZ), Roger Ver (Bitcoin Jesus))

5 months into 2024 and already these major events have happened:

1. The Bitcoin Halving (reducing supply from 6.25 to 3.125 BTC)

2. The Bitcoin ETF approval in the USA (by the SEC)

3. Sam Bankman-Fried imprisonment (FTX)

4. Craig Wright is not Satoshi Nakamoto (UK judge)

5. Changpeng Zhao (CZ) from Binance sentenced to 4 months in prison (USA)

6. Roger Ver (Bitcoin Jesus) charged with mail fraud and tax evasion, arrested in Spain

Saturday, April 20, 2024

4 months into 2024 (Halving, Bitcoin ETF, FTX Sam Bankman-Fried, and Craig Wright is not Satoshi Nakamoto)

We are only 4 months into 2024 and already these major events have happened:

1. The Bitcoin Halving (reducing supply from 6.25 to 3.125 BTC)

2. The Bitcoin ETF approval in the USA (by the SEC)

3. Sam Bankman-Fried imprisonment (FTX)

4. Craig Wright is not Satoshi Nakamoto (UK judge)

Friday, April 12, 2024

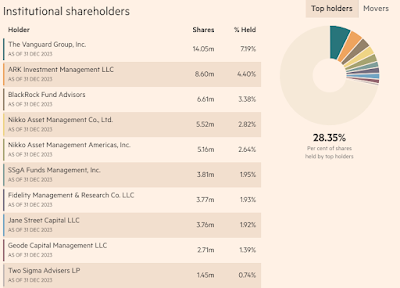

BlackRock has big influence in the Bitcoin ecosystem, but who owns BlackRock?

BlackRock has big influence in the Bitcoin ecosystem. For example with the development of the Bitcoin ETF (IBIT) and investments within the Bitcoin Mining Industry (such as Marathon and Riot) but who owns large chunks of BlackRock?

- The Vanguard Group, Inc. = 8.23%

- BlackRock Fund Advisors = 4.42%

- SSgA Funds Management, Inc. = 3.93%

- Temasek Holdings Pte Ltd. (Investment Management) = 3.42%

- Capital Research & Management Co. (Global Investors) =2.63%

- Capital Research & Management Co. (World Investors) = 2.36%

- Managed Account Advisors LLC = 2.16%

- Charles Schwab Investment Management, Inc. = 2.13%

- Morgan Stanley Smith Barney LLC (Investment Management) = 1.90%

- Geode Capital Management LLC = 1.78%

(Source: The Financial Times 12 April 2024

[https://markets.ft.com/data/equities/tearsheet/profile?s=BLK:NYQ]

Wednesday, April 10, 2024

BlackRock, Vanguard, et al own a large percentage of Marathon Digital Holdings Inc (MARA), Riot Platforms Inc (RIOT) and Coinbase Global Inc (COIN)

As a snapshot, it is interesting and enlightening to see some of the large percentage of owners within the Bitcoin ecosystem:

- Marathon Digital Holdings Inc (MARA): The Vanguard Group owns 8.55% and BlackRock 5.73%

- Riot Platforms Inc (RIOT): 10.21% is owned by The Vanguard Group and 6.74% by BlackRock

- Coinbase Global Inc (COIN): 7.19% is owned by The Vanguard Group, 4.4% by ARK Investment Management, and 3.38% by BlackRock

|

| Marathon Digital Holdings Inc (MARA) |

|

| Riot Platforms Inc (RIOT) |

Tuesday, March 26, 2024

Lowest prices projected for Bitcoin on the 1st of January each year (Bitcoin Power Law Model)

Using the Bitcoin Power Law Model, these are the LOWEST (the floor) prices projected for Bitcoin on the 1st of January each year.

These figures have been rounded down and are approximate:

2024 = $24,000

2025 = $35,000

2026 = $50,000

2027 = $70,000

2028 = $96,000

2029 = $130,000

2030 = $174,000

2031 = $228,000

2032 = $295,000

2033 = $375,000

2034 = $480,000

2035 = $600,000

2036 = $750,000

2037 = $930,000

2038 = $1,140,000

2039 = $1,390,000

2040 = $1,600,000

The Bitcoin Power Law Theory

Friday, February 2, 2024

Year 2009 to 2050 - find any date and price - Bitcoin Price Log/Log Power Law Growth Corridor

Bitcoin Price Log/Log Power Law Growth Corridor

- Find any date and see the Mid, Low or High price in US Dollars from the year 2009 to 2050 (table format).

- This is Inspired by BTC POWER LAW (@Giovann35084111) and Harold Burger (@hcburger1)

- Click here or the full URL is:

Friday, January 12, 2024

Bitcoin is not crypto, and crypto is not Bitcoin

Monday, January 1, 2024

2024 is here, strap yourself in... The Fourth Turning

2024 will be a massive year for bitcoin, economics, elections, geopolitics and war.

I predict calm will return in 2028

The period around 2024 is predicted to be a time of significant global change and upheaval, potentially marking the midst of the Crisis phase in their historical cycle model. This phase is characterized by societal upheaval and the reconstruction of social and political structures.

-

Using Bitcoin options and futures to drive down the price and accumulate BTC at lower levels is a strategy often employed by large institut...

-

As we bid farewell to 2024 and welcome the dawn of 2025, I wish everyone health, happiness, and success in the year ahead. Stay positive, e...

-

BlackRock's iShares Bitcoin ETP will be listed on: a) Euronext Paris and Xetra under the "IB1T " ticker b) On Euronext Amsterd...