November 5, 2024, is shaping up to be a night of high energy and deep significance on both sides of the Atlantic. In the United States, millions of Americans are heading to the polls to vote in a critical presidential election. At the same time, in the United Kingdom, people are gathering to celebrate Bonfire Night, or Guy Fawkes Night, with fireworks and bonfires. While these events are distinct in purpose and tradition, both involve themes of civic engagement, historical reflection, and the power of the people.

USA Elections 2024: The Stakes Are Higher Than Ever

In the United States, the 2024 election has captured global attention with a rematch that’s as polarizing as it is consequential. Voters are choosing between Donald Trump, who has mounted an unprecedented return campaign, and Vice President Kamala Harris, who represents continuity from the current administration. This election is not just a contest between two individuals; it reflects broader ideological divides within the country, from economic policies to healthcare reform to the United States' role on the world stage.

Donald Trump’s campaign has emphasized a return to his brand of economic populism, and border security, and promises to “drain the swamp” in Washington. His supporters view him as a champion of the working class and a force against establishment politics. Trump’s campaign has also centred on deregulatory policies, pledging to free businesses from perceived governmental constraints to foster economic growth. He’s taken a hard line on immigration, pushing for stricter policies and promising to restore "law and order."

Kamala Harris, on the other hand, has focused on continuing the policies she supported as Vice President, such as affordable healthcare, climate action, and progressive social policies. Her campaign has emphasized unity, justice, and inclusivity, appealing to a broad coalition of young voters, minorities, and moderate Democrats. Harris has also made history as the first woman of colour to serve as Vice President, and if she wins, she would become the first female President in U.S. history—a milestone with enormous symbolic and practical impact.

The outcome of this election will shape the United States for years to come, impacting both domestic policy and international relations. The world will be watching as swing states tally their votes, and communities across the U.S. hold their breath in anticipation of the results.

Bitcoin and the Future of U.S. Financial Policy

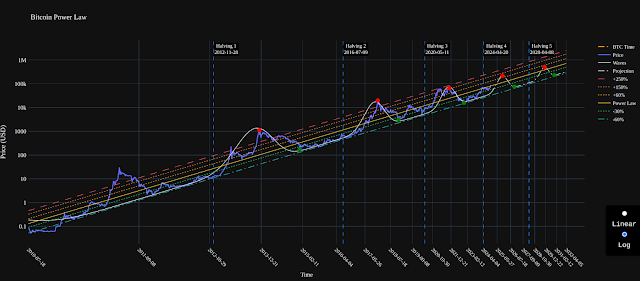

One of the unique issues in this election has been the role of cryptocurrency, particularly Bitcoin, in the American economy. Digital currencies have gained popularity as both an investment asset and a potential alternative to traditional banking systems. Each candidate has a different stance on how the U.S. should engage with Bitcoin and other digital currencies, which could impact the future of financial policy and the economy at large.

Donald Trump has been vocal in his scepticism of Bitcoin and cryptocurrency in general, often warning of its potential risks and volatility. He has argued that cryptocurrency could undermine the U.S. dollar and facilitate illegal activities. A second Trump administration might push for stricter regulations on digital currencies to protect traditional banking and national economic stability. This could lead to policies that discourage or even restrict Bitcoin use, potentially limiting the growth of cryptocurrency markets within the U.S.

Kamala Harris, however, has taken a more open-minded approach to digital assets, considering cryptocurrency as an area ripe for innovation. While Harris has not fully endorsed Bitcoin as an alternative currency, she has signalled a willingness to work with blockchain experts and has proposed regulations that balance innovation with consumer protection. If Harris were to win, it’s possible that the U.S. would adopt a more supportive stance on cryptocurrency, integrating it more fully into the economy and even exploring a government-backed digital dollar, as some other countries have done.

Bonfire Night in the UK: A Celebration of Democracy and Tradition

While Americans are casting their votes, British people are marking Bonfire Night, a beloved tradition with its own unique historical significance. Also known as Guy Fawkes Night, Bonfire Night commemorates the failed Gunpowder Plot of 1605, when Guy Fawkes and his co-conspirators attempted to blow up the Houses of Parliament and assassinate King James I. The plot was foiled, and the king survived, leading to annual celebrations of the monarchy's preservation and, over time, a broader reflection on British governance and unity.

Across the UK, communities come together to celebrate with firework displays, bonfires, and the burning of effigies of Guy Fawkes. Families gather in parks and back gardens to enjoy seasonal treats and watch the skies light up with bright, colourful displays. For many, Bonfire Night is a reminder of the long-standing democratic traditions in Britain and the importance of protecting freedom from the threat of violence and tyranny.

Bridging Two Worlds on November 5th

Although separated by geography and purpose, the events in the United States and the United Kingdom on November 5th are bonded by themes of history, tradition, and civic duty. For Americans, this election represents a chance to set a new direction or reaffirm a previous path, with the future of the economy, the climate, healthcare, and more hanging in the balance. For Britons, Bonfire Night is an opportunity to celebrate their rich history and the triumph of democratic ideals, while remembering that political engagement is as crucial today as it was in 1605.

Both the election and Bonfire Night evoke a shared spirit of community and collective action. While Americans await the final vote tallies, the skies over the UK will be filled with fireworks—a reminder that democracy, in all its forms, remains a powerful force for unity and progress. This November 5th, as votes are counted and bonfires are lit, the world is reminded of the enduring importance of people-powered change, from the streets of Washington to the parks of London.