Tuesday, May 7, 2024

Hal Finney (Bitcoin) and Terry A. Davis (TempleOS)

Friday, May 3, 2024

5 months into 2024 (Halving, Bitcoin ETF, FTX Sam Bankman-Fried, and Craig Wright is not Satoshi Nakamoto, Changpeng Zhao (CZ), Roger Ver (Bitcoin Jesus))

5 months into 2024 and already these major events have happened:

1. The Bitcoin Halving (reducing supply from 6.25 to 3.125 BTC)

2. The Bitcoin ETF approval in the USA (by the SEC)

3. Sam Bankman-Fried imprisonment (FTX)

4. Craig Wright is not Satoshi Nakamoto (UK judge)

5. Changpeng Zhao (CZ) from Binance sentenced to 4 months in prison (USA)

6. Roger Ver (Bitcoin Jesus) charged with mail fraud and tax evasion, arrested in Spain

Saturday, April 20, 2024

4 months into 2024 (Halving, Bitcoin ETF, FTX Sam Bankman-Fried, and Craig Wright is not Satoshi Nakamoto)

We are only 4 months into 2024 and already these major events have happened:

1. The Bitcoin Halving (reducing supply from 6.25 to 3.125 BTC)

2. The Bitcoin ETF approval in the USA (by the SEC)

3. Sam Bankman-Fried imprisonment (FTX)

4. Craig Wright is not Satoshi Nakamoto (UK judge)

Friday, April 12, 2024

BlackRock has big influence in the Bitcoin ecosystem, but who owns BlackRock?

BlackRock has big influence in the Bitcoin ecosystem. For example with the development of the Bitcoin ETF (IBIT) and investments within the Bitcoin Mining Industry (such as Marathon and Riot) but who owns large chunks of BlackRock?

- The Vanguard Group, Inc. = 8.23%

- BlackRock Fund Advisors = 4.42%

- SSgA Funds Management, Inc. = 3.93%

- Temasek Holdings Pte Ltd. (Investment Management) = 3.42%

- Capital Research & Management Co. (Global Investors) =2.63%

- Capital Research & Management Co. (World Investors) = 2.36%

- Managed Account Advisors LLC = 2.16%

- Charles Schwab Investment Management, Inc. = 2.13%

- Morgan Stanley Smith Barney LLC (Investment Management) = 1.90%

- Geode Capital Management LLC = 1.78%

(Source: The Financial Times 12 April 2024

[https://markets.ft.com/data/equities/tearsheet/profile?s=BLK:NYQ]

Wednesday, April 10, 2024

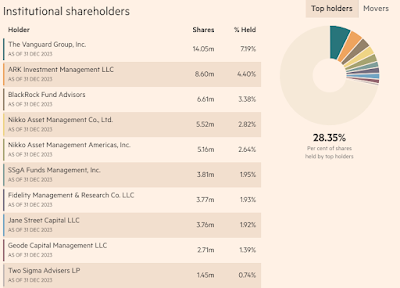

BlackRock, Vanguard, et al own a large percentage of Marathon Digital Holdings Inc (MARA), Riot Platforms Inc (RIOT) and Coinbase Global Inc (COIN)

As a snapshot, it is interesting and enlightening to see some of the large percentage of owners within the Bitcoin ecosystem:

- Marathon Digital Holdings Inc (MARA): The Vanguard Group owns 8.55% and BlackRock 5.73%

- Riot Platforms Inc (RIOT): 10.21% is owned by The Vanguard Group and 6.74% by BlackRock

- Coinbase Global Inc (COIN): 7.19% is owned by The Vanguard Group, 4.4% by ARK Investment Management, and 3.38% by BlackRock

|

| Marathon Digital Holdings Inc (MARA) |

|

| Riot Platforms Inc (RIOT) |

Tuesday, March 26, 2024

Lowest prices projected for Bitcoin on the 1st of January each year (Bitcoin Power Law Model)

Using the Bitcoin Power Law Model, these are the LOWEST (the floor) prices projected for Bitcoin on the 1st of January each year.

These figures have been rounded down and are approximate:

2024 = $24,000

2025 = $35,000

2026 = $50,000

2027 = $70,000

2028 = $96,000

2029 = $130,000

2030 = $174,000

2031 = $228,000

2032 = $295,000

2033 = $375,000

2034 = $480,000

2035 = $600,000

2036 = $750,000

2037 = $930,000

2038 = $1,140,000

2039 = $1,390,000

2040 = $1,600,000

The Bitcoin Power Law Theory

Friday, February 2, 2024

Year 2009 to 2050 - find any date and price - Bitcoin Price Log/Log Power Law Growth Corridor

Bitcoin Price Log/Log Power Law Growth Corridor

- Find any date and see the Mid, Low or High price in US Dollars from the year 2009 to 2050 (table format).

- This is Inspired by BTC POWER LAW (@Giovann35084111) and Harold Burger (@hcburger1)

- Click here or the full URL is:

Friday, January 12, 2024

Bitcoin is not crypto, and crypto is not Bitcoin

Monday, January 1, 2024

2024 is here, strap yourself in... The Fourth Turning

2024 will be a massive year for bitcoin, economics, elections, geopolitics and war.

I predict calm will return in 2028

The period around 2024 is predicted to be a time of significant global change and upheaval, potentially marking the midst of the Crisis phase in their historical cycle model. This phase is characterized by societal upheaval and the reconstruction of social and political structures.

Friday, December 15, 2023

The Bitcoin Power Law Growth Corridor (by Harold Burger)... excellent video explanation

The Bitcoin Power Law Growth Corridor (by Harold Burger)... excellent video explanation by Chad Thackray

|

https://youtu.be/wfi-bst4hmA?si=jolV5-xhxa7JhNrr

Text from YouTube video:

"We implement a model popularised by Harold Burger, which uses a log-log chart of bitcoin and then applies linear regression to establish a long term corridor of price action, which has worked well over the past 10 years. It's a useful indicator to zoom out and see the big picture, without getting worked up over day to day price action."

See also:

Monday, December 11, 2023

Bitcoin Stock To Flow (S2F) Trading Rule, by PlanB

- Approximately 6 months before the halving purchase Bitcoin

- And then 18 months after the halving sell the Bitcoin

Friday, September 29, 2023

Bitcoin as an investment with research from major institutions

- ARK

- Fidelity

- Franklin Templeton

- https://www.fidelitydigitalassets.com/

- https://www.fidelitydigitalassets.com/research-and-insights

- https://www.fidelitydigitalassets.com/research-and-insights/bitcoin-first

- https://www.fidelitydigitalassets.com/sites/default/files/documents/bitcoin-first.pdf

- https://www.fidelitydigitalassets.com/research-and-insights/bitcoin-supply-demand

- https://www.fidelitydigitalassets.com/sites/default/files/documents/valuing-bitcoin-report.pdf

- https://www.fidelitydigitalassets.com/research-and-insights/understanding-bitcoin-halving

- https://www.fidelitydigitalassets.com/topics/digital-assets-and-traditional-investing

Friday, July 28, 2023

Wednesday, July 26, 2023

Bitcoin: Asset Allocation with Crypto Application of Preferences for Positive Skewness (BlackRock)

Bitcoin: Asset Allocation with Crypto Application of Preferences for Positive Skewness (BlackRock)

Wednesday, July 19, 2023

Everything You Want To Know About Bitcoin (But Are Afraid To Ask). Questions and Answers About Bitcoin

Now available in these formats:

Digital download (Amazon Kindle eBook)

- Paperback (black and white printed ISBN-13: 9798852862839)

- Hardcover (colour printed ISBN-13: 9798852864031)

- Audiobook (coming soon)

- Limited edition copies (coming soon)

- Special Limited edition signed copies (coming soon)

Available to purchase from:

Description:

Discover the intriguing world of Bitcoin, with "Everything You Want To Know About Bitcoin (But Are Afraid To Ask). Questions and Answers About Bitcoin". As we traverse an era of economic unpredictability, there's a financial game-changer breaking boundaries - Bitcoin. Despite its transformative power, understanding its intricacies can often feel like decrypting an enigma due to the dispersed and scattered information available.

This comprehensive guide is your reliable navigator through the labyrinth of Bitcoin, perfect for eager novices and seasoned investors alike. It unravels the complex layers of cryptocurrency, takes you through the pivotal infrastructure of blockchain, unveils the mechanics of Bitcoin mining, and much more.

"Everything You Want To Know About Bitcoin (But Are Afraid To Ask). Questions and Answers About Bitcoin" rises above the fray to address over 100 of the most probing questions about Bitcoin, offering both digestible and in-depth responses that cater to beginners and advanced enthusiasts. Your quest for answers ends here, within the groundbreaking chapters of this book.

- What is the process of 'Halvening' and why is it significant?

- Could the elusive Satoshi Nakamoto be more than one person?

- What role could Bitcoin play in your investment portfolio?

- How does it intersect with global economics and regulations?

- What challenges could impede its future?

This enlightening guide promises to equip you with:

- A profound comprehension of Bitcoin's mechanics and the underlying blockchain technology.

- An objective perspective on Bitcoin's legal ramifications, potential rewards, and inherent risks.

- Proficiency in buying, selling, and securely storing Bitcoin.

- An insightful exploration into Bitcoin's influence on the global financial terrain and its prospects for future expansion.

Embark on your digital revolution today. Don't allow fear or confusion to cloud your understanding of Bitcoin.

Let "Everything You Want To Know About Bitcoin (But Are Afraid To Ask). Questions and Answers About Bitcoin" be your launchpad into the future of finance.

Tuesday, June 20, 2023

BlackRock filing with Securities and Exchange Commission (SEC) for a Bitcoin Exchange Traded Fund (ETF)

https://www.sec.gov/Archives/edgar/data/1980994/000143774923017574/bit20230608_s1.htm

On each Business Day, as soon as practicable after 4:00 p.m. Eastern Time (“ET”), the Trust Administrator evaluates the bitcoin held by the Trust as reflected by the CF Benchmarks Index and determines the net asset value of the Trust and the NAV. For purposes of making these calculations, a Business Day means any day other than a day when NASDAQ is closed for regular trading. The CF Benchmarks Index employed by the Trust is calculated on each Business Day by aggregating the notional value of bitcoin trading activity across major bitcoin spot exchanges.

The CF Benchmarks Index is designed based on the IOSCO Principles for Financial Benchmarks and is a Registered Benchmark under the UK Benchmark Regulations (“BMR”). The administrator of the CF Benchmarks Index is CF Benchmarks Ltd. (the “Index Administrator”) a UK-incorporated company, authorized and regulated by the Financial Conduct Authority (“FCA”) of the UK as a Benchmark Administrator, under UK BMR. The CF Benchmarks Index serves as a once-a-day benchmark rate of the U.S. dollar price of bitcoin (USD/BTC), calculated as of 4:00 p.m. ET. The CF Benchmarks Index aggregates the trade flow of several bitcoin exchanges, during an observation window between 3:00 p.m. and 4:00 p.m. ET into the U.S. dollar price of one bitcoin at 4:00 p.m. ET. Specifically, the CF Benchmarks Index is calculated based on the “Relevant Transactions” (as defined in “Business of the Trust—Valuation of Bitcoin; the CF Benchmarks Index”) of all of its constituent bitcoin exchanges, which are currently Bitstamp, Coinbase, itBit, Kraken, Gemini, and LMAX Digital (the “Constituent Platforms”), and which may change from time to time.

Saturday, June 3, 2023

Bitcoin Price Log/Log Power Law Growth Corridor (Inspired by Harold Burger) up to the year 2050

The Bitcoin Price Log/Log Power Law Growth Corridor (Inspired by Harold Burger).

Data presented in table format from 2009 - 2050.

Find any date and see the Mid, Low or High price in US Dollars.

Notice how close the price of Bitcoin in US Dollars was in November 2022 to the "Low" within the log/log power law corridor of growth...

Monday, May 22, 2023

From the WBD Podcast... Michael Saylor's 10 Rules for Life

Michael Saylor's 10 Rules for Life:

1. Focus your energy

2. Guard your time

3. Train your mind

4. Train your body

5. Think for yourself

6. Curate your friends

7. Curate your environment

8. Keep your promises

9. Stay cheerful, be constructive

10. Upgrade the world

Bonus...

1. Study history

2. Study applied statistics

3. Take advantage of new technology

- What Bitcoin Did: https://youtu.be/-w-aYVXcOk4

- https://bbcdsatoshi.com/

Wednesday, May 10, 2023

Bitcoin price prediction 2023 - 2033 lowest price based on log log power law devised by Harold Burger

Wednesday, May 3, 2023

Very good article here... Is the Federal Government Trying to Kill Off Crypto? (New York Magazine)

Source: https://nymag.com/intelligencer/2023/05/is-the-federal-government-trying-to-kill-off-crypto.html

Is the Federal Government Trying to Kill Off Crypto? The industry sure thinks so — even as the White House denies it.

By Jen Wieczner, New York features writer who covers Wall Street, business, and crypto

The crypto company was essentially reverse-engineered for Washington, D.C.’s stamp of approval. Protego Trust, founded by a lawyer turned venture capitalist, was betting big that it could be the squeaky-clean, bona fide bank that crypto needed to win Wall Street’s business. It had spent $80 million pursuing a coveted approval for a national trust charter, winning conditional approval in 2021. It then raised more than $100 million — at a reported $2 billion valuation — from big crypto companies, including Coinbase (as well as now-bankrupt FTX), among other investors. Its board included a former Fortune 500 CEO and even the onetime head of the Office of the Comptroller of the Currency, the country’s chief bank regulator.

“We courted regulation. We did everything that was required in order to build a pristine financial institution to serve the most discerning institutional clients,” says Protego founder Greg Gilman. Protego planned to work exclusively with professional investing firms (no individual retail traders), providing safekeeping (what’s known as “custody” in the crypto industry) along with trading and lending.

But when Protego told the OCC in February that it had completed all of the agency’s requirements for full approval, its application was denied on a technicality — one that the OCC had never mentioned before, according to a person familiar with the situation.

“In the end, it feels like there was an unannounced and unexplained policy change that derailed our efforts,” says Gilman, who declined to comment on the specifics. Protego subsequently laid off the majority of its staff, and the company’s future is uncertain.

In the crypto industry, the experience of Protego and that of many others like it has led to an almost universal conviction that financial regulators are purposefully trying to put them out of business — not by barring them explicitly but rather through the recent appearance of a web of policies, both written and unwritten, that together make it unfeasible or impossible for crypto firms to operate in the U.S. “It feels coordinated. It feels like a carpet-bombing,” says Kristin Smith, CEO of the Blockchain Association. “And there’s a certain realization that we have to fight back.”

Some observers from the government and law communities are raising similar complaints. “It sure seems like the OCC and, specifically, Acting Comptroller of the Currency Mike Hsu really doesn’t want to approve these applicants,” says a former regulatory official, pointing out that it’s unusual for a firm to receive conditional approval only to later be denied. “Generally speaking, once you get your conditional approval to open, it’s kind of a glide path. But there’s a lot of supervisory discretion inherent in that whole licensing process, where if they’re looking for a certain outcome, there are ways to get there.”

Meanwhile, former federal prosecutor Katie Haun, who now runs a crypto-focused venture-capital firm in Silicon Valley, accused the government of “a coordinated regulatory campaign to stymie progress in the sector” in a March column in the Wall Street Journal. “These efforts are misguided, reckless and potentially unconstitutional,” she wrote. The crypto community broadly makes the case that any large-scale legal restrictions against its activities would need to be passed by Congress and signed into law by the president — they cannot just be made up on the fly by overreaching regulators who happen not to like their business model.

Haun and others have compared current government efforts to Operation Choke Point, a secret Obama-era policy that sought to sideline legal but widely reviled industries like payday lending, gun dealing, and porn by cutting off their access to the banking system. Many in the crypto industry — which critics tend to see as neither legitimate nor productive — are now calling what’s happening to crypto “Operation Choke Point 2.0.”

“It’s different from the original Choke Point, in that they are being pretty public about it — nobody’s guessing their views,” says the former regulatory official, who spoke on condition of anonymity. “Another difference is that it’s actually broader in scope.”

The prominent (and conservative) D.C. law firm Cooper & Kirk added heft to the theory of coordination with a new white paper titled “Operation Choke Point 2.0: The Federal Bank Regulators Come for Crypto.” As the lawyers put it, “The federal bank regulators … are waging a clandestine, financial war against the cryptocurrency industry.” Nearly a decade ago, Cooper & Kirk sued the FDIC, Fed, and OCC on behalf of payday lenders for the original Operation Choke Point, successfully securing a settlement from the FDIC. “This pattern of events is not random, and we have seen it before,” the Cooper & Kirk lawyers wrote in their new paper. “The evidence of backroom coercion is only beginning to emerge.”

The various government regulators, for their part (I reached out to five regulatory agencies and the White House), largely maintain that they are acting independently and are not specifically out to get crypto. But they acknowledge that they’re guarding against what they see as major risks inherent to cryptocurrencies — particularly after crypto behemoth FTX was exposed as a fraud less than six months ago. A White House spokesperson called the allegations of a coordinated effort against crypto “categorically false”: “This administration supports responsible technological innovations that make financial services cheaper, faster, safer, and more accessible. We’ve also been outspoken about the need for congressional action to address the risks posed by cryptocurrencies to the financial system and the American people.” The OCC declined to comment on specific banks except to say that Protego did not meet all of the requirements before its conditional approval expired on February 4. A spokesperson for the FDIC pointed to a line from a joint statement in February from the trio of bank regulators — the Fed, OCC, and FDIC — about crypto-related risks, which says, “Banking organizations are neither prohibited nor discouraged from providing banking services to customers of any specific class or type, as permitted by law or regulation.” The Fed declined to comment beyond previous public statements.

Some members of Congress, however, have suspicions of their own. On March 9, the House Subcommittee on Digital Assets, Financial Technology and Inclusion held a hearing — the group’s inaugural meeting — titled “Coincidence or Coordinated? The Administration’s Attack on the Digital Asset Ecosystem.” It was less investigation than listening session as the House considers a handful of supportive bills for the industry. Various crypto executives and academics testified, citing broad frustrations with the regulatory process, but it’s not clear what the lawmakers’ next steps, if any, will be.

Whether one buys the crypto industry line of a stealth war, or the official administration line of various regulators just doing their jobs, there are objectively several fronts where the sector is facing much more intense scrutiny. Not only are banks refusing to open checking accounts for crypto-related businesses — which some suspect reflects guidance from their government supervisors (as was the case in the first Operation Choke Point) — but federal financial regulators have declined to charter or credential crypto companies en masse and warned banks about business activities involving crypto. Then there’s Gary Gensler’s recent onslaught.

For months, Gensler’s Securities and Exchange Commission has led a crackdown on the crypto industry, dropping a steady drumbeat of charges and warnings on various digital-currency companies on a roughly weekly basis. Since October, when the SEC penalized Kim Kardashian for illegally promoting crypto, Gensler has only turned up the heat. In January, the SEC brought charges against two of the biggest corporate players in the crypto space, institutional lender Genesis and exchange Gemini — then against Kraken, another large U.S.-based exchange, the following month. The party was just getting started: Then-fugitive crypto founder (and alleged scammer) Do Kwon was next, followed by former NBA star Paul Pierce, billionaire crypto founder Justin Sun, and a host of celebrities including Lindsay Lohan, Akon, and Soulja Boy. The same day the agency dropped the complaint against Lohan, it sent a warning shot in the form of a Wells Notice to Coinbase, the largest (and only publicly traded) crypto company in the country, portending a looming legal battle royal. And in mid-April, the SEC charged Bittrex and its co-founder with securities-law violations — a couple of weeks after the Seattle-based crypto exchange said it would shutter its U.S. business and operate exclusively offshore.

Stephen Palley, a D.C.-based lawyer at the large corporate law firm of Brown Rudnick, wrote on Twitter that the actions show the SEC “intends to completely shut down any crypto-related businesses in the United States”:

Indeed, the Gensler-led crackdown over the past six months has, according to many in the sector, pushed things to a crisis point, forcing a desperate decision: Fight against the federal government or flee the country. Brian Armstrong, founder and CEO of Coinbase, which has more than 100 million customers (most of them in the U.S.), announced in April that he is considering moving the firm offshore — possibly to the U.K., where he has been meeting with regulators. “Anything is on the table — including relocating or whatever is necessary,” Armstrong said at a conference in London. Coinbase then announced that it had obtained a license to operate in Bermuda. (Last week, Coinbase sued the SEC to get a yes-or-no answer on a petition for new rules for the industry, which it hopes would settle fundamental questions about which parts of the company’s business are legal and which are not.) “This is not just a fight for Coinbase,” Paul Grewal, Coinbase’s chief legal counsel, told Laura Shin on her podcast, Unchained. “This is a fight for all of crypto.”

Last week, Armstrong and Coinbase added shield emoji to their Twitter names with the company tweeting “Shields Up” — partly to signal support for a new “Stand With Crypto” campaign featuring blue-shield NFTs. The shields spread across other accounts, giving Crypto Twitter the indisputable look of heading to war.

If the military rhetoric feels excessive, it’s easier to understand when you consider that crypto hawks in the federal government are using similar terms. In late March, Senator Elizabeth Warren, who has been leading the fight against crypto on Capitol Hill, tweeted a campaign promo video that begins with the text “Elizabeth Warren is Building an Anti-crypto Army” — a headline published by Politico but clearly one that the senator wishes to embrace and promote. (Warren’s team declined to comment.) “Elizabeth Warren said the quiet part out loud,” says an executive at a major U.S. crypto firm.

Gensler, meanwhile, has made clear that he views the crypto industry as a harbor for criminals while refusing to take the complaints about his enforcement strategy too seriously. On April 1, Gensler changed his Twitter profile picture to one of him wearing sunglasses — black, animated-pixel sunglasses that are known on the internet as Thug Life glasses and are often found on the crypto mascot Doge (you know, the famous Shiba Inu). It’s known as the “Deal With It” meme and many in crypto interpreted it as a message that Gensler’s mind was set against their business. The SEC did not respond to requests for comment about “Operation Choke Point 2.0,” though a person close to the agency said the photo was an April Fools’ Day joke.

The newly aggressive posture toward crypto across multiple agencies is broadly in line with the administration’s stated view of the sector. On January 27, the White House issued a policy statement that advocates a hard-line approach to the industry. “At President Biden’s direction, we have spent the past year identifying the risks of cryptocurrencies and acting to mitigate them using the authorities that the Executive Branch has,” the statement read. It urged Congress to grant law enforcement more power to police the industry while warning it not to “make our jobs harder” by allowing “mainstream” investors to “dive headlong into cryptocurrency markets.”

At the very same moment that the White House’s statement crossed the transom, 11:30 a.m. that Friday, the Federal Reserve Board denied an application by Custodia Bank to become a member of the Federal Reserve System. Custodia, an uninsured crypto custodian chartered in Wyoming, had held out hope for years for approval, but the Fed concluded that its business “presented significant safety and soundness risks.”

Part of Custodia’s 86-page denial, though, hinged on a new Fed policy that was also published at 11:30 a.m. on Friday, January 27, and which seemed written specifically to bar uninsured banks like Custodia from crypto-related activities. The regulators had already warned banks, in strong language, that they did not look kindly on crypto business. In early January, the Fed, FDIC, and OCC put out a three-way joint statement saying that such crypto activities are “highly likely to be inconsistent with safe and sound banking practices.”

Custodia, whose founder and CEO, Caitlin Long, previously spent a couple of decades at Wall Street banks, including Morgan Stanley and Credit Suisse, is now suing the Fed. She says the application process contained “substantial procedural irregularities”: For one, the Fed’s policy statement itself was released during a Fed blackout period ahead of a rates-setting meeting. “There have been numerous agency overreaches in the last two months, and when one reads them all together, the only conclusion is that the agencies decided to throw caution to the wind, to go well beyond their legal authorities, to try to push this industry into the shadows,” says Long. (“I think people are reading far too much into what are essentially coincidences in timing,” said one administration official.)

Within weeks of Custodia’s denial, Protego was denied, as was fellow crypto custodian Paxos. Like Protego, Paxos had been granted conditional approval for national trust bank charters from the OCC in 2021. A spokesperson for the OCC confirmed that, like Protego’s, Paxos’s conditional approvals expired when the bank did not meet all of the requirements by the deadline. “We’re disappointed to not move forward with the OCC national trust,” Chad Cascarilla, CEO and co-founder of Paxos, which has taken in more than $500 million in venture funding, said in a statement. Behind the scenes, however, there was more drama, and people close to the companies felt that the OCC made it impossible for crypto firms to be approved.

In Protego’s case, the company had lined up more than $100 million in necessary funding ahead of its deadline, Gilman confirmed. But a month later, the OCC said that Protego’s application had failed because the money wasn’t physically in the bank yet, according to a person familiar with the situation. All Protego needed to do was wire the money in (it had previously been told that only needed to happen four days before its official opening date, once its application had been approved). But the OCC told the company that it was too late, the person said, because the conditional approval had expired. Protego was well-versed in how the process typically worked at the OCC: Brian Brooks, who ran the OCC during the Trump administration, sat on the company’s board.

In March, another event raised suspicions of coordinated anti-crypto actions even outside the ranks of those who usually pay attention to, or care about, such things. Following the demise of two relatively crypto-friendly banks, Silvergate and Silicon Valley Bank, the New York Department of Financial Services seized Signature Bank, which also catered to crypto firms, over the weekend following SVB’s collapse. This occurred despite the fact that Signature was not insolvent, according to board member and former congressman Barney Frank. “They’ve never said we were insolvent,” Frank, who is known for drafting the landmark Dodd-Frank legislation regulating the banking industry in the wake of the 2008 financial crisis, told me. “That’s why I speculate that using us as a poster child to say ‘Stay away from crypto’ was the reason.”

The closure of Signature was a stark contrast to the treatment of First Republic Bank, which faced a similar run (it lost $100 billion in deposits) but was not taken over by regulators at the time. Instead, the same evening the NYDFS closed Signature Bank, First Republic announced that it had received rescue funding from the Fed. The question of why Signature was not given access to the Fed’s new bank-bailout program has become a simmering fixation for many in the crypto industry, who see it as another sign that the bank was targeted for its ties to digital currency. The Wall Street Journal’s editorial page — which has a history of criticizing Frank — agreed with him in March: “The evidence increasingly suggests the former Congressman could be right … Signature made mistakes managing its balance sheet, but it shouldn’t be summarily executed because regulators have deemed some of their customers too politically toxic to exist.” While the NYDFS has denied that Signature was shut down due to its connections to crypto, bidders for Signature were reportedly required to abandon the bank’s crypto business, according to Reuters. And when Signature was subsequently sold to Flagstar Bank, some $4 billion in crypto-related deposits were excluded from the deal.

A spokesperson for the FDIC said that it offered bidders what’s known as “a whole bank transaction” for Signature Bank and that prospective buyers were allowed to bid on all of its deposits — crypto-related or not. The FDIC referred questions about why the deal did not include Signature’s digital-asset business to Flagstar, which did not respond to requests for comment.

A spokesperson for the NYDFS said the decision to take possession of Signature “was only made when it was clear the bank would be unable to do business in a safe and sound manner on Monday.” At a conference hosted by Chainalysis in New York this month, NYDFS superintendent Adrienne Harris said, “The idea that the taking possession of Signature was about crypto and this is ‘Choke Point 2.0’ is really ludicrous.”

Yet in a report that the FDIC released on Friday analyzing Signature’s failure, crypto figures heavily: “Poor management” was the primary cause of the bank’s collapse but, in particular, that it “failed to understand the risk of its association with the crypto industry.”

It’s enough of a pattern for even more-levelheaded crypto advocates to call the case of Signature Bank a smoking gun of a secret operation to rid the U.S. of its crypto businesses. “I think all the conspiracy theorists are definitely onto something,” says Sheila Warren, CEO of the Crypto Council for Innovation. “There is enough circumstantial evidence to say, ‘Oh yeah, that’s a real thing.’”

USA Elections 2024 and Bonfire Night in the UK: A Night of Democracy, History, and Anticipation For Bitcoin

November 5, 2024, is shaping up to be a night of high energy and deep significance on both sides of the Atlantic. In the United States, mill...

-

The log/log power law governing Bitcoin appears robust. However, could there be a plausible and logical scenario in which this power law i...

-

BlackRock has big influence in the Bitcoin ecosystem. For example with the development of the Bitcoin ETF (IBIT) and investments within the ...

-

The Bitcoin Power Law Growth Corridor (by Harold Burger)... excellent video explanation by Chad Thackray https://youtu.be/wfi-bst4hmA?si=jo...