- The title is: 'Zero to Hero, or why you should put 5% of your cash/fiat into Bitcoin'.

- The alternative title is the 'Purpose for BBCD Satoshi - rationale for investing in Bitcoin'.

Bitcoin | Blockchain | Cryptocurrency | Digital Asset/Capital/Credit | ... @BBCDSatoshi ...

Bitcoin Specific Metrics:

There is a cottage industry that has built up for providing new statistics and charts for looking at in granular detail, valuing and predicting prices and changes with Bitcoin. These include:

200 Week Moving Average Heatmap

The Puell Multiple

Stock-to-Flow Model

Bitcoin Logarithmic Growth Curves.

(Source for details below: https://www.lookintobitcoin.com/charts/)

200 Week Moving Average Heatmap

In each of its major market cycles, Bitcoin's price historically bottoms out around the 200 week moving average. This indicator uses a colour heatmap based on the % increases of that 200 week moving average. Depending on the month-by-month % increase of the 200 week moving average, a colour is assigned to the price chart. Long term Bitcoin investors can monitor the monthly colour changes. Historically, when we see orange and red dots assigned to the price chart, this has been a good time to sell Bitcoin as the market overheats. Periods where the price dots are purple and close to the 200 week MA have historically been good times to buy. The 200WMA heatmap can be a useful tool as it shows on a historical basis whether the current price is overextending (red dots) and may need to cool down. It can also show when Bitcoin price may be good value on a historical basis. This can be when the dots on the chart are purple or blue. Over more than ten years, $BTC has spent very little time below the 200 week moving average (200WMA) which is also worth noting when thinking about price predictions for Bitcoin or a Bitcoin price forecast.

Created by and further reading: Plan B

https://twitter.com/100trillionUSD

The Puell Multiple

This metric looks at the supply side of Bitcoin's economy - bitcoin miners and their revenue. It explores market cycles from a mining revenue perspective. Bitcoin miners are sometimes referred to as compulsory sellers due to their need to cover fixed costs of mining hardware in a market where price is extremely volatile. The revenue they generate can therefore influence price over time. The Puell Multiple is calculated by dividing the daily issuance value of bitcoins (in USD) by the 365-day moving average of daily issuance value.

There are periods of time where the value of bitcoins being mined and entering the ecosystem is too great or too little relative to historical norms. Understanding these periods of time can be beneficial to the strategic Bitcoin investor. The chart above highlights periods where the value of Bitcoin's issued on a daily basis has historically been extremely low (Puell Multiple entering green box), which produced outsized returns for Bitcoin investors who bought Bitcoin here. It also shows periods where the daily issuance value was extremely high (Puell Multiple entering the red box), providing advantageous profit-taking for Bitcoin investors who sold here.

The Puell Multiple uses the upper red band on the chart to show when miner revenues in USD terms are significantly higher than historical norms (in this case the 365-day moving average). Over the majority of Bitcoins’ existence, these periods have been when the price of $BTC has also reached its major highs. So the Puell Multiple can be a useful Bitcoin forecasting tool to identify based on this metric whether price is too high and needs to drop (when the indicator is in the red zone), or whether it is too low and may need to bounce (indicator is in the green zone).

Created by and further reading: David Puell

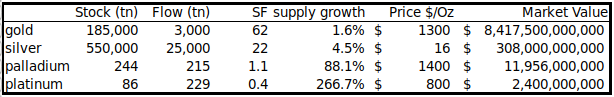

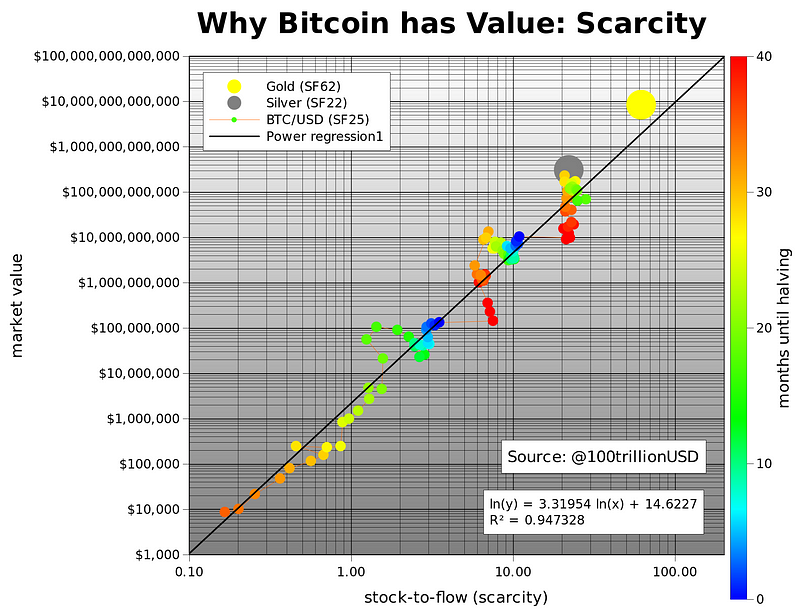

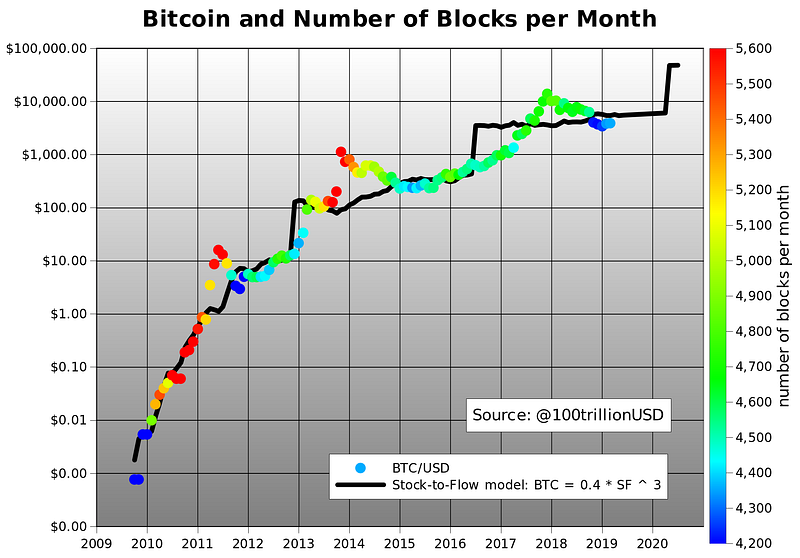

Stock-to-Flow Model

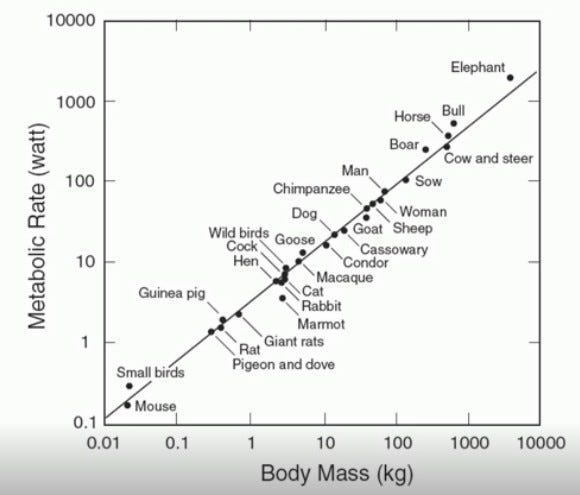

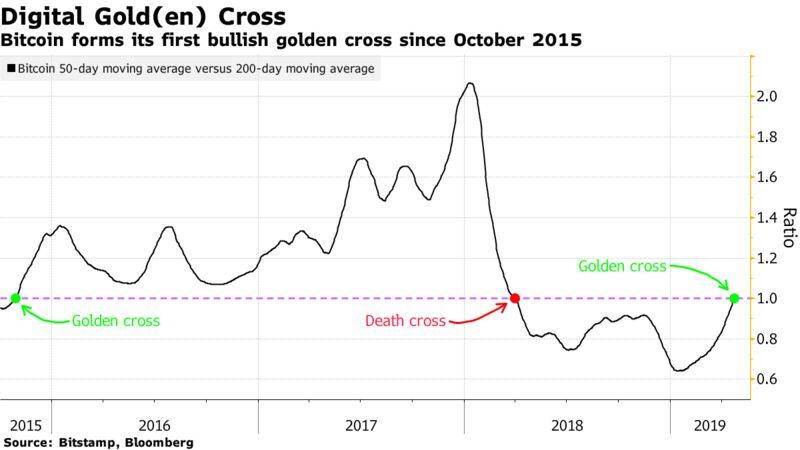

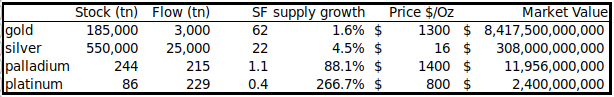

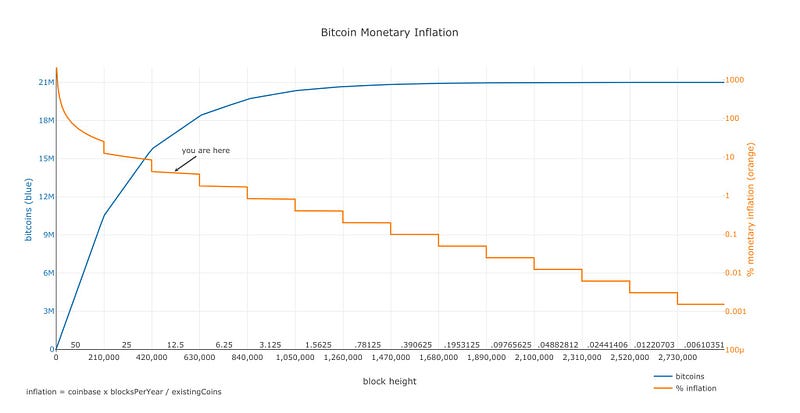

This model treats Bitcoin as being comparable to commodities such as gold, silver or platinum. These are known as 'store of value' commodities because they retain value over long time frames due to their relative scarcity. It is difficult to significantly increase their supply i.e. the process of searching for gold and then mining it is expensive and takes time. Bitcoin is similar because it is also scarce. In fact, it is the first-ever scarce digital object to exist. There are a limited number of coins in existence and it will take a lot of electricity and computing effort to mine the 3 million outstanding coins still to be mined, therefore the supply rate is consistently low.

Stock-to-flow ratios are used to evaluate the current stock of a commodity (total amount currently available) against the flow of new production (amount mined that specific year). For store of value (SoV) commodities like gold, platinum, or silver, a high ratio indicates that they are mostly not consumed in industrial applications. Instead, the majority is stored as a monetary hedge, thus driving up the stock-to-flow ratio. A higher ratio indicates that the commodity is increasingly scarce - and therefore more valuable as a store of value.

On the Stock-to-Flow Model chart price is overlaid on top of the stock-to-flow ratio line. Price continues to follow the stock-to-flow of Bitcoin over time. The theory, therefore, suggests that we can project where price may go by observing the projected stock-to-flow line, which can be calculated as we know the approximate mining schedule of future Bitcoin mining.

The coloured dots on the price line of this chart show the number of days until the next Bitcoin halving (sometimes called 'halvening') event. This is the event where the reward for mining new blocks is halved, meaning miners receive 50% fewer bitcoins for verifying transactions. Bitcoin halvings are scheduled to occur every 210,000 blocks – roughly every four years – until the maximum supply of 21 million bitcoins has been generated by the network. That makes stock-to-flow ratio (scarcity) higher so in theory price should go up. This has held true previously in Bitcoin's history.

Created by and further reading: Plan B

https://twitter.com/100trillionUSD

Bitcoin Logarithmic Growth Curves

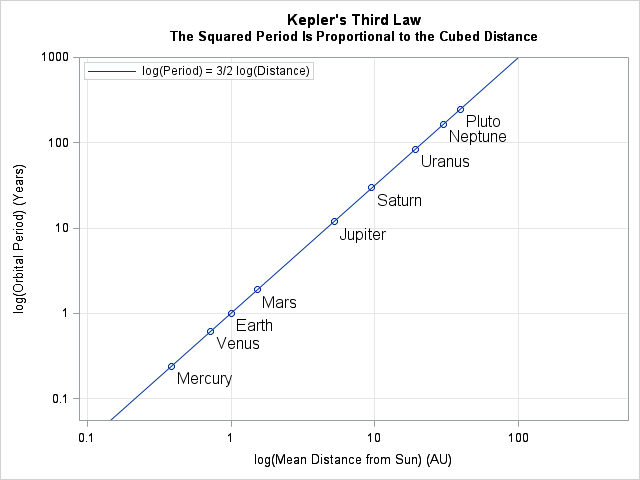

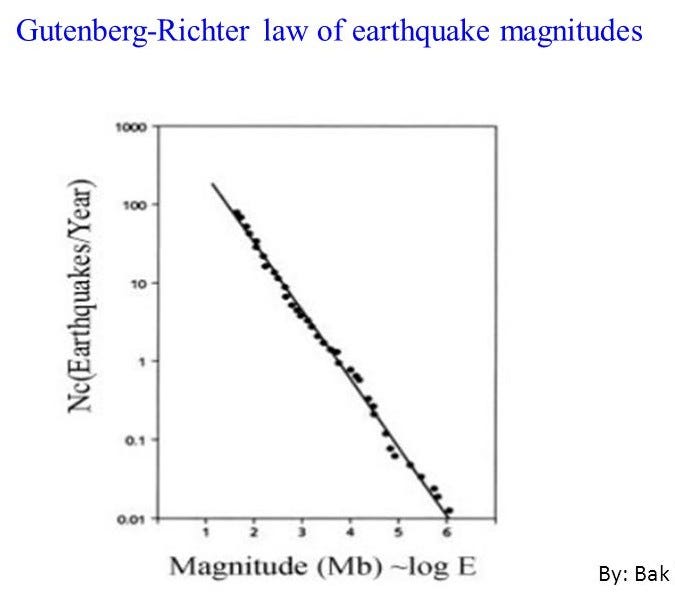

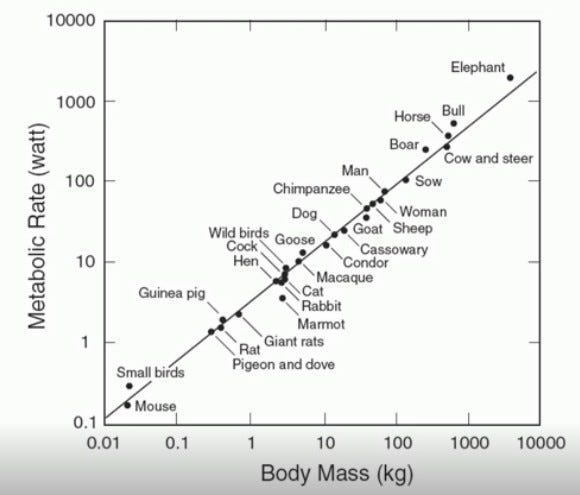

Logarithmic analysis uses historical data to forecast and predict future prices. The Bitcoin Logarithmic growth curve takes all the historical price data of Bitcoin and uses log growth analysis to develop curves that project a potential path of future price growth.

Historically, price tends to bounce between the upper and lower bounds of the logarithmic growth curve. The reason for this is because Bitcoin moves through market cycles.

Further reading: Harold Christopher Burger, Cole Garner and Quantadelic

https://twitter.com/ColeGarnerBTC/media

https://twitter.com/quantadelic/media

Metrics, Statistics and Levels:

With traditional investing there are various measures and metrics that are used. These tools can also be used with investing for Bitcoin. These include:

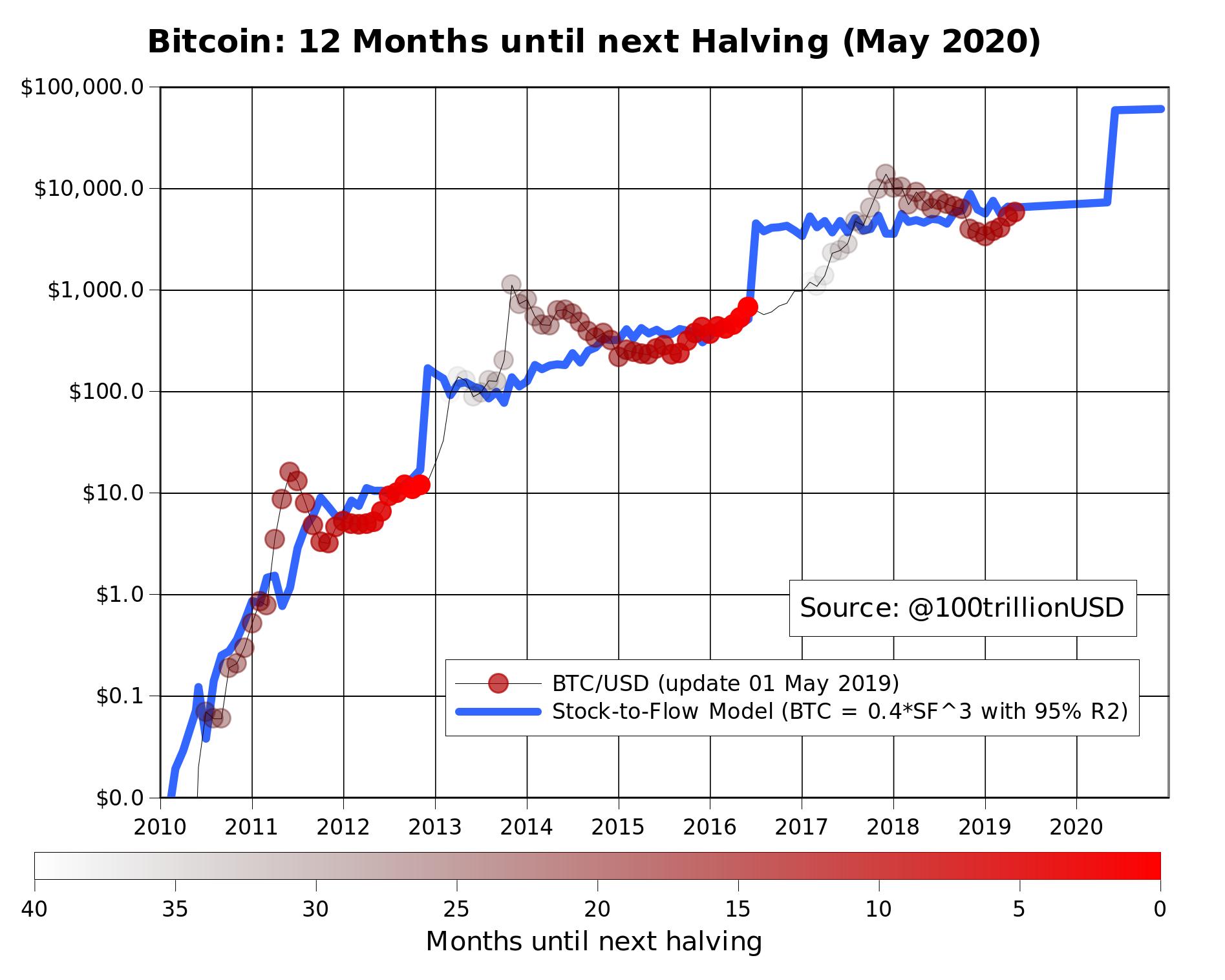

MACD

RSI

Fibonacci Levels

(Source for details below: https://www.fidelity.com/learning-center/overview)

MACD

The Moving Average Convergence/Divergence indicator is a momentum oscillator primarily used to trade trends. Although it is an oscillator, it is not typically used to identify overbought or oversold conditions. It appears on the chart as two lines which oscillate without boundaries. The crossover of the two lines give trading signals similar to a two moving average system.

RSI

The Relative Strength Index (RSI), is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. Signals can be generated by looking for divergences and failure swings. RSI can also be used to identify the general trend.

FIBONACCI LEVELS

The Fibonacci retracement tool plots percentage retracement lines based upon the mathematical relationship within the Fibonacci sequence.

Fibonacci numbers are a sequence of numbers in which each successive number is the sum of the two previous numbers: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, and so on. These retracement levels provide support and resistance levels that can be used to target price objectives.

Fibonacci retracements are displayed by first drawing a trend line between two extreme points. A series of six horizontal lines are drawn intersecting the trend line at the Fibonacci levels of 0.0%, 23.6%, 38.2%, 50%, 61.8%, and 100%.

Here are some useful links which include a visual block chain explorer and countdown for the bitcoin halving.

Please look at each of these recommended external links. At some point in your Bitcoin journey they will be useful to you https://bbcdsatoshi.blogspot.com/p/media.html

I've created a donation page with the purpose to see:

Here is a large collection of resources for learning all about Bitcoin. Click here

If you have any more suggestions to add to this list, please send me a message at:

Hello and welcome, this is the new home for the blog BBCD Satoshi. Thank you for looking!

Over the next few months we'll update material and add new pages.

In one form or another, the Blog has been running since 2018. Rather than deleting all the old posts, I've downloaded them all and uploaded them to this blog. You'll see quite a few posts going back over time.

Feel free to follow and message on Twitter:

https://twitter.com/bbcdsatoshi

Thanks once again.

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

“Buy Bitcoin, you’ll thank yourself in the future”

" As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: boring grey in colour, not a good conductor of electricity, not particularly strong [..], not useful for any practical or ornamental purpose .. and one special, magical property: can be transported over a communications channel" — Nakamoto [2]

"What do antiques, time, and gold have in common? They are costly, due either to their original cost or the improbability of their history, and it is difficult to spoof this costliness. [..] There are some problems involved with implementing unforgeable costliness on a computer. If such problems can be overcome, we can achieve bit gold." — Szabo [3]

"Precious metals and collectibles have an unforgeable scarcity due to the costliness of their creation. This once provided money the value of which was largely independent of any trusted third party. [..][but] you can’t pay online with metal. Thus, it would be very nice if there were a protocol whereby unforgeably costly bits could be created online with minimal dependence on trusted third parties, and then securely stored, transferred, and assayed with similar minimal trust. Bit gold." — Szabo [4]

"For any consumable commodity [..] doubling of output will dwarf any existing stockpiles, bringing the price crashing down and hurting the holders. For gold, a price spike that causes a doubling of annual production will be insignificant, increasing stockpiles by 3% rather than 1.5%."

"It is this consistently low rate of supply of gold that is the fundamental reason it has maintained its monetary role throughout human history."

"The high stock-to-flow ratio of gold makes it the commodity with the lowest price elasticity of supply."

"The existing stockpiles of Bitcoin in 2017 were around 25 times larger than the new coins produced in 2017. This is still less than half of the ratio for gold, but around the year 2022, Bitcoin's stock-to-flow ratio will overtake that of gold" — Ammous[5]

Instead of being 40 and wishing you were 20 again, imagine you are 90 years old, looking back at yourself today. What would you tell yoursel...