https://www.cmegroup.com/education/featured-reports/an-in-depth-look-at-the-economics-of-bitcoin.html

An In-Depth Look at the Economics of Bitcoin

- 24 Apr 2018

- By Bluford Putnam and Erik Norland

- Topics: Economic Events

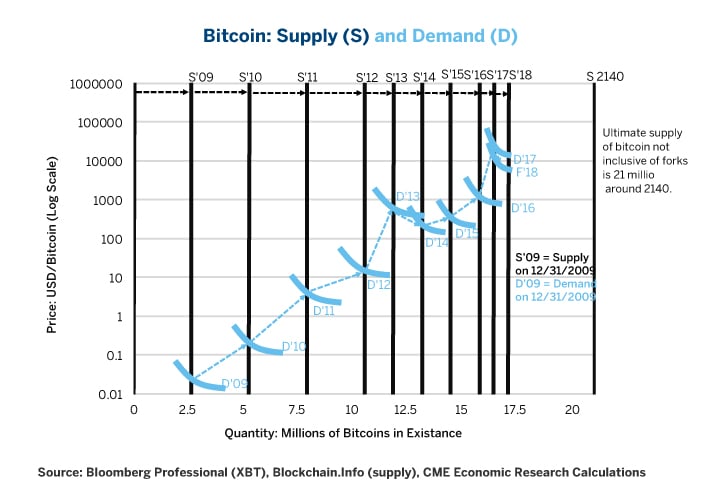

What is most striking about the economics of bitcoin is the juxtaposition of the certainty of supply and the uncertainty of demand. The rate at which bitcoin is mined has been highly predictable and, unlike almost any other asset, currency or commodity, its ultimate supply is a known quantity, fixed in advance. There will never be more than 21 million coins. This feature makes bitcoin supply almost perfectly inelastic. No matter how high the price rises, miners will not ultimately produce any more than the prescribed amount. Moreover, price rises will not even necessarily incentivize a more rapid mining of bitcoin. Even if they did, it would mean miners create more bitcoin today at the expense of creating less of it in the future since the total supply will reach a hard, asymptotic limit of 21 million coins, expected to be reached by 2140 or so, based on the mining algorithms.

In this report we analyze the economics of the bitcoin marketplace by finding parallels in the world of commodities to understand what it means to have an inelastic supply. Then, we move to the relatively more difficult task of demand analysis to complete the bitcoin economics picture.

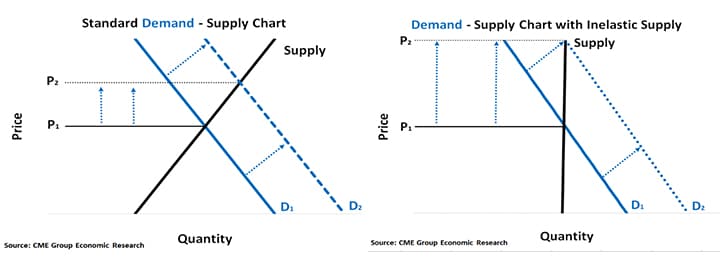

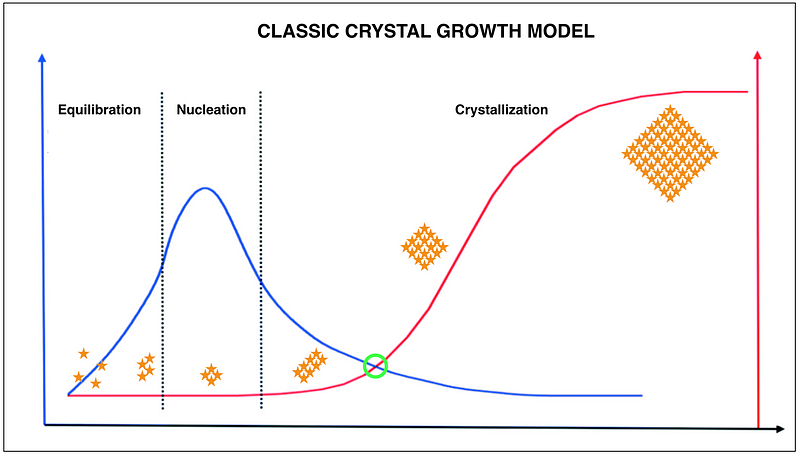

The supply inelasticity explains in large part why bitcoin is so volatile. Items with inelastic supply show a greater response to demand shifts than items with elastic supply. The same is true of demand: the more inelastic the demand, the greater the price changes in response to small fluctuations in either supply or demand. In the abstract example below, we show the relatively modest price response to an upward shift in demand for a market with flexible supply elasticity on the left and contrast it with the much bigger price response from the same demand shift in a constrained supply market on the right.

Take as an illustration the case of natural gas. Natural gas is a classic example of a market with highly inelastic supply and demand. If prices soar today, consumers will still need natural gas to generate electricity, heating and to fuel industrial processes; and they will be willing to pay up for it, at least in the short term. Natural gas demand is therefore highly inelastic.

The same is true of natural gas supply. If prices double, producers will likely not be able to supply a great deal more of it in the short term. Similar relationships hold for crude oil, although are less dramatic. What differentiates the analysis of commodities like natural gas and crude oil from bitcoin is that their long-term supply and demand shows a meaningful degree of elasticity, even if the short-term supply is more about inventory swings than production adjustments. If natural gas or crude oil prices experience a sustained rise, producers can and will find ways of producing more of them – or at least they have so far in history.

Meanwhile, consumers will find ways to use them more efficiently in response to higher prices. This is not the case for bitcoin directly, although rising prices might increase the probability of “forks” that split bitcoin into the original and a spinout currency such as Bitcoin Cash (August 1, 2017), Bitcoin Gold (October 24, 2017), and Bitcoin Private (February 28, 2018).

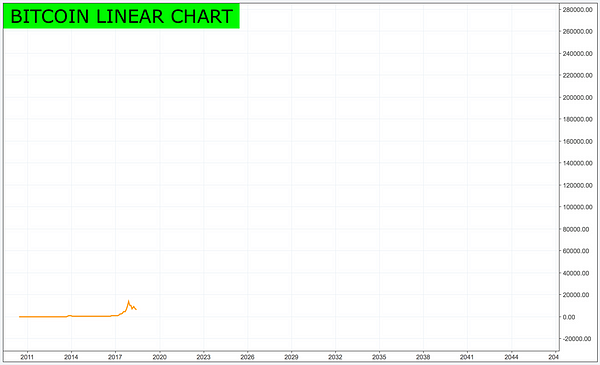

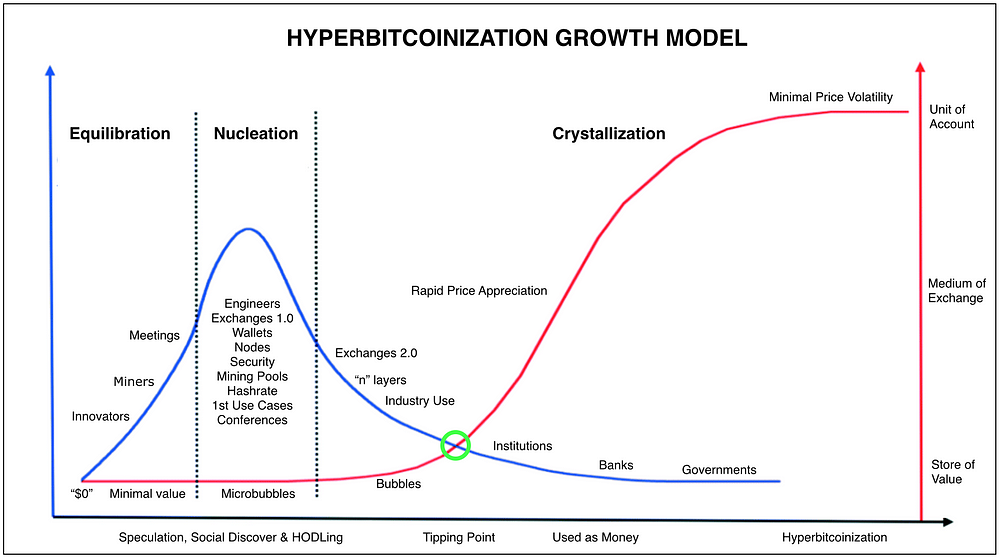

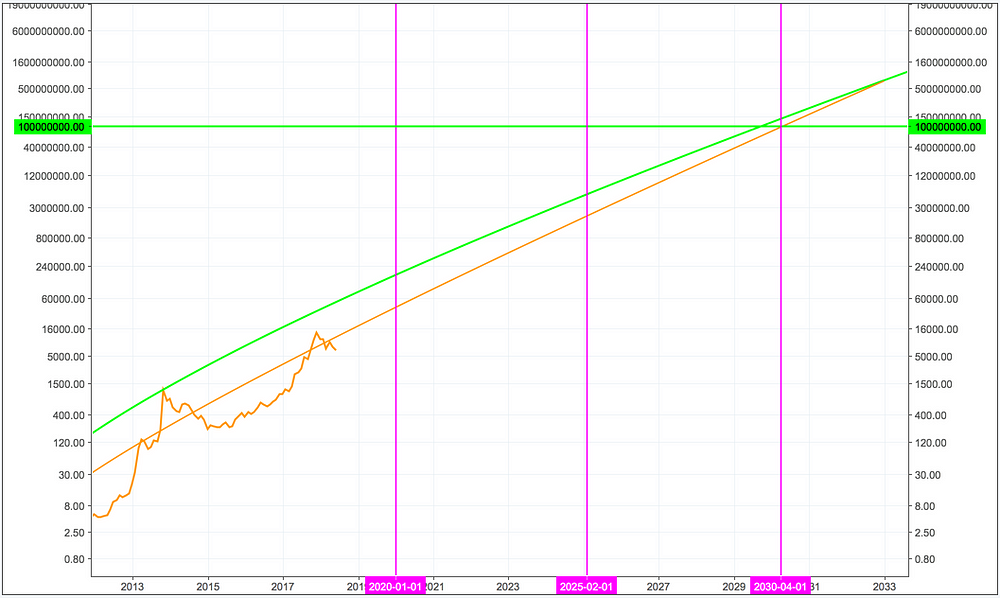

Bitcoin’s limited and highly inelastic supply is also a major factor driving its price appreciation, a rise so spectacular that it can only be appreciated when seen on a log scale. In bitcoin’s first four years, supply grew by roughly 2.5 million coins per year. Even then prices were rising as the user community grew. Since then supply has continued to grow but the pace has slowed substantially while demand has occasionally dipped, even on a year-on-year basis.

Bitcoin’s limited supply and soaring price make it difficult to be used as a medium of exchange outside of the crypto currency space. Imagine one’s regret if one uses bitcoin to purchase a mundane item such as a cup of coffee only to find that the bitcoin spent on a cup of coffee would have been worth millions of dollars a few years later. As such, investors treat bitcoin as a highly unreliable store of value – a bit like gold on steroids.

One often asked question is: will bitcoin replace fiat currencies such as the U.S. dollar? We think that the answer is a resounding no. Bitcoin’s price is too volatile to compete as a store of value; Bitcoin’s transaction costs are too high and too variable for it to be used as a medium of exchange.

Most importantly, for an asset to function economically as a medium of exchange, it must depreciate slowly over time – something that is impossible with a fixed supply. That loss of value is precisely what makes them useful. Without the fear of inflation, holders of currency tend to hoard rather than spend it. This is why most major central banks, such as the Federal Reserve, European Central Bank, and the Bank of Japan, for example, have set modest inflation targets of 2%, as suggested back in the 1960s by Professor Milton Friedman. The inflation target creates a dis-incentive to hoard the currency, since hoarding a currency depresses economic growth and creates financial instability. The Japanese yen, the one fiat currency that has experienced deflation over the past few decades, is a case in point. Far from being a virtuous store of value, the Japanese deflation produced a depressed, underperforming economy that the Bank of Japan is desperately trying to turn around with a colossal quantitative easing program four times bigger than that undertaken by the Federal Reserve or European Central Bank, relative to the size of the Japanese economy.

Bitcoin is “mined” by computers solving cryptographic math problems. In exchange for solving the problems, miners receive bitcoin. Those math problems grow in difficulty over time, increasing the required computational power required to solve them. This in turn drives up the equipment and especially the electricity cost of producing bitcoins. One needs more and more computers and to make them run at peak speeds, they must be kept cool.

This makes the economic analysis of bitcoin a bit like energy and metals. For example, as of late 2017, the swing producers of crude oil in the U.S. were probably profitable at around $40 per barrel. Above that price, there are incentives to add to production. Below that price, the incentives are to curtail production. Also like bitcoin, the difficulty of extracting energy from the earth has increased substantially over time. For instance, humanity went through the easiest oil supplies located near the surface many decades ago. Now marginal supply increases come mostly from fracking deep under the ground, from offshore drilling or from oil in remote, difficult to access locations. In the second half of the 19th century, when oil was first produced in large quantities, one unit of energy invested in oil extraction produced around 150 units of energy. By the 1970s that was down to around 30 units of energy for each one invested and that ratio fell to around 15 by 2000 and is probably below 10 today. This has been a factor in driving oil prices higher. In the energy industry, it is widely assumed that the marginal producers have a cost of production near $40 per barrel. It bears mentioning that oil prices rarely traded at $40 until about 2005, when they rose above that level and have only occasionally looked back.

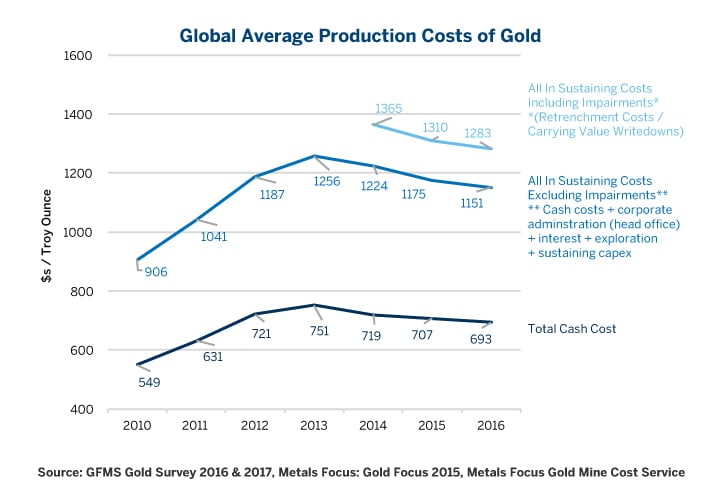

For metals like copper, gold and silver, there are two numbers to watch: the cash cost and all-in sustaining costs. Cash costs give one a sense of price levels at which producers will maintain current production. All-in sustaining costs give one a sense of what current and anticipated future price levels will be necessary to incentivize additional investment in future production. For example, for gold, cash-cost for mine operators averages around $700 per ounce while the all-in sustaining costs are around $1,250 per ounce (Figure 3).

What is interesting for gold, silver and copper is that after their prices began to fall in 2011, it squeezed the profit margins of operators, who in turn found ways to streamline their businesses and cut their production costs. The same is true of the 2014-16 collapse in energy prices which may have lowered the marginal cost of production from $50 to $40 per barrel of crude. Like mining metals and extracting fossil fuels, mining bitcoin is also a competitive business. Not surprisingly we see a similar feedback loop between the bitcoin price and mining-supply difficulty – in this case difficulty is measured in terms of the number of calculations required to solve the crypto-algorithm to unlock a few more bitcoins in the mining process.

Glancing at Figure 4, it is obvious that as the required number of computations (“difficulty”) has risen, producing bitcoin has become more expensive. It is not a stretch of the imagination to hypothesize that the exponential rise in the difficulty of mining bitcoin has contributed to the exponential rise in price. True, perhaps, but not the complete story. There is another side to this feedback loop. Notice what happened to “difficulty” after the first bitcoin bear market (a 93% drop) in 2010-11. Its inexorable rise came to a two-year long halt until prices recovered. It was only once when the next price bull market began in 2013 that “difficulty” began increasing again. A similar phenomenon occurred in the aftermath of the 2013-15 bitcoin bear market (an 84% decline). There too “difficulty” stagnated until prices began their next bull market. Curiously “difficulty” has not begun to stagnate yet despite a 50% drop in bitcoin prices from their recent highs. The relationship between “difficulty” and price trends suggest that bitcoin may remain in a congested pattern for some time to come.

Thus, bitcoin supply appears to have at least one similarity with that of energy and metals. When prices fall producers must take measures that cause production costs to stagnate or even fall. While “difficulty” never appears to decline, the cost of computing power has fallen over time by as much as 25% per year. As such, if “difficulty” goes sideways for a year, the actual cost of production probably falls as the amount of energy needed to perform the same number of calculations declines. Just as metals and energy producers find ways to reduce cost after bear markets, the bitcoin mining community appears to do the same.

One last comment on supply before we move on to demand: it has long been rumored that the founding community of bitcoin controls something in the order of 3-5 million coins. If this is true, in theory higher prices could (and probably would) encourage them to part with their coins in exchange for fiat currencies or other assets. When one takes this into account, bitcoin supply might not be perfectly inelastic in the very short term. A similar phenomenon exists in precious metals. When prices rise, we see an increase in the recycling of gold and silver (secondary supply). What is interesting, however, is that that recycling appears to respond to price but does not drive prices. For gold and silver, the only supply that appears to drive price is mining supply. Likewise, if an existing holder of bitcoin liquidates some or all of her holdings, this increases its short-term availability but does nothing to influence its total long-run supply, and in that sense, is more like a temporary inventory adjustment.

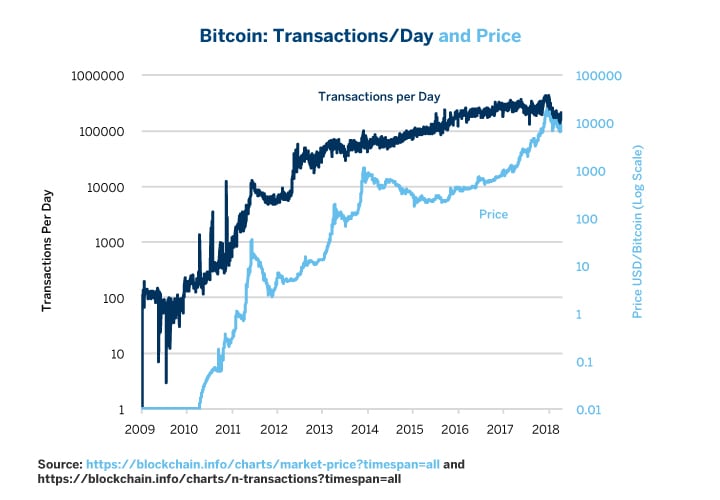

While bitcoin supply is extremely transparent, bitcoin demand is rather opaque. That said, there are a few quantifiable items that we do know about bitcoin demand. First, we have a pretty good idea of the number of bitcoin transactions performed each day. Secondly, and more importantly, it appears that fluctuations in bitcoin transaction costs play a major role in determining price corrections.

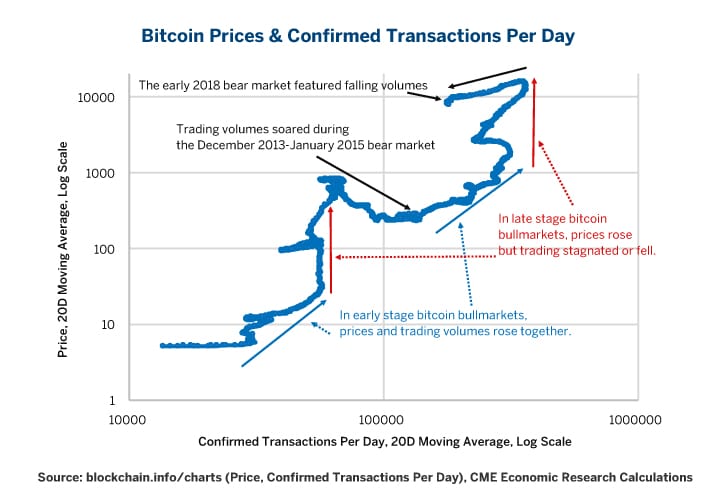

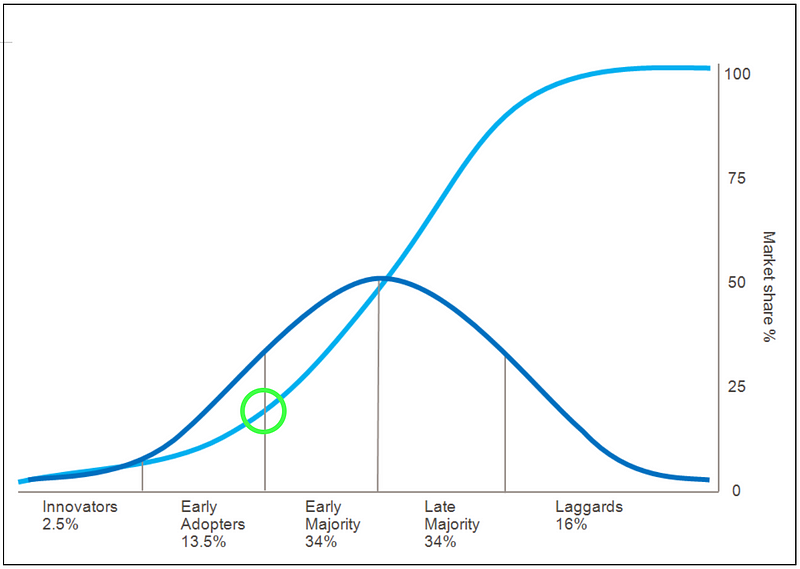

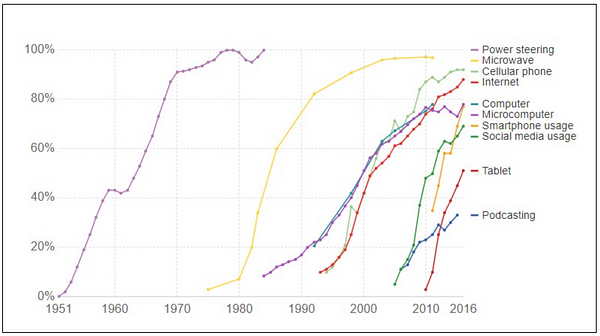

There appears to be a loose relationship between the growth rate of transactions and the rise/decline in price. For example, the number of transactions stopped growing in 2012, about one year before bitcoin’s 2013 peak and bear market. It began to rise again in 2014 before bitcoin prices began to recover in earnest but has been stagnating since the end of 2016 (Figures 5 and 6), perhaps foreshadowing the recent correction. What is particularly striking about the most recent correction is that the number of transactions have not risen as prices have fallen as they did during the December 2013-January 2015 bear market. During the two previous bull markets, the number of transactions began rising well in advance of the actual rally in bitcoin prices. Towards the end of the two previous bull markets, prices soared as the number of transactions stopped rising.

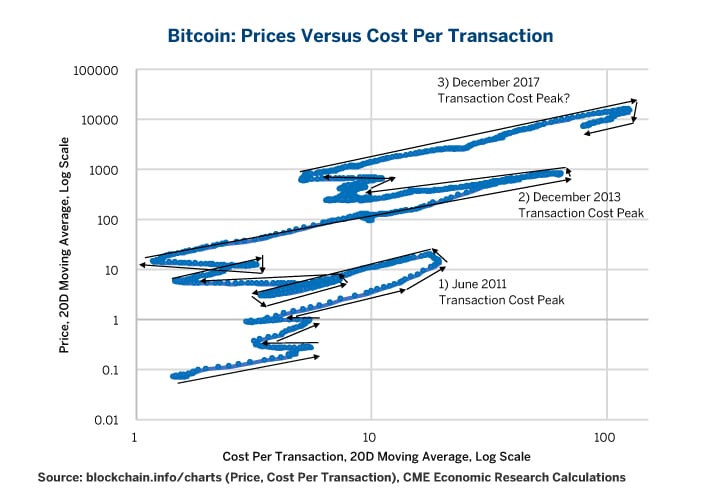

The relationship between bitcoin prices and transaction costs is even more compelling. Trading costs spiked from $2 to around $30 per transaction in late 2010 just before bitcoin prices suffered a 93% collapse. As bitcoin transaction costs subsequently fell, another bull market developed. Transaction costs edged higher in 2012 and then soared to over $80 by early 2013 which coincided with another collapse in bitcoin prices. By 2015, transaction costs eased towards $8 and another bull market began. Starting in late 2016, they began to rise again and are now up towards $100-$150 per transaction (Figures 7 and 8). This third spike in transaction costs may be closely related to the recent correction in bitcoin prices as high transaction costs may play a role in causing demand for the cryptocurrency to wither.

We are not suggesting that bitcoin prices are a function of trading costs or vice versa; however, there is an association between the two with mutual feedback loops. When bitcoin prices rise, eventually transaction costs appear to rise as well. When transaction costs reach levels that market participants can no longer bear, the price of bitcoin often corrects. A decline in prices puts downward pressure on transaction costs which, at least in the past, allowed for another bitcoin bull market once they had corrected to lower levels.

If stagnating numbers of trades and rising transaction do in fact play a role in provoking bitcoin price corrections, then one might hypothesize that a given correction might last until transaction costs fall and the number of transactions begins to rise again. Given the spike in transaction costs in early 2018 and the sharp (more than 50%) decline in the number of transactions being recorded in bitcoin during the same period, if these variables are in fact drivers of bitcoin prices, the price of bitcoin may have not yet found its balancing point. Although bitcoin prices are down about 50% from their recent highs, do not forget that in bitcoin’s two previous routs it fell by 84-93%. What happens to bitcoin prices going forward is, of course, unknowable at present. That said, we would keep any eye on these factors as proxies for the health of bitcoin demand.

When one thinks of incentives and reward structures, one might want to analyze some parallels with how shareholder value is created. This is tricky with bitcoin. Bitcoin certainly does not fit the definition of a company. It has no board of directors, no balance sheet, no income statement and no cash flow statement. That said, bitcoin does have a couple of features which need to be understood in the context of incentive structures. And, this adds a little more complexity to the supply analysis as well.

Miners and transaction validators receive rewards in bitcoin. One can see a corporation’s shares as an internal currency used to compensate and motivate employees, aligning their interests with those of the organization. To that end, the number of bitcoins in existence is comparable to the “float” of a corporation – the number of shares issued to the public.

When bitcoin forks into a new currency, such as Bitcoin Cash, the move can be analyzed in a manner comparable to a corporate action such as a spin out. In a spin out, a corporation can give each of its shareholders new shares in a division of the firm that is being released to the public as separate and independent entity. Likewise, when bitcoin most recently forked, the owner of each bitcoin received one unit of Bitcoin Cash, a new and separate cryptocurrency.

In a sense, bitcoin could be viewed as a reference index on the crypto currency space more generally. Many new alt-coins, in addition to copying bitcoin’s technology, are more easily purchased via bitcoin than they are by using fiat currencies. Bitcoin’s central role in this ecosystem makes its price a bit like an index on the health of the entire ecosystem itself. Not surprisingly, the prices of other cryptocurrencies like Ethereum and Ripple are highly correlated with bitcoin when seen from a fiat currency perspective.

A quick diversion back to supply is useful here. The existence of forks in bitcoin serves to modify some of our intuitions on supply. That is, while bitcoin’s supply is fixed, the supply of cryptocurrencies is not. Indeed, rising bitcoin prices incent bitcoin forks. This makes a lot of sense but it does complicate the analysis as it is a reminder that one should not look at bitcoin in isolation but as an anchor for the whole cryptocurrency space.

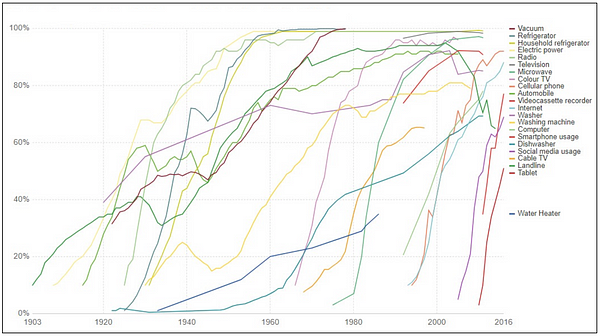

Even if bitcoin fails to replace fiat currencies, it will not necessarily be without long-term economic impact. One possible result of the development of cryptocurrencies is that central banks may one day decide to issue their own distributed ledger currencies as Venezuela is struggling to attempt to do today with the launch of the “petro.” Former Fed Chairman Alan Greenspan once compared making monetary policy to driving a car guided only by a cracked rearview mirror. Even now, important policy decisions must be based upon imperfectly estimated economic numbers that are weeks or months old by the time they become available. In 2018, economic policy making is still a vestige of the 20th century.

Blockchain technology has the potential to allow policy makers to issue their own cryptocurrencies that will give them real time information on inflation, nominal and real GDP. It will not allow them to peer through the front windshield into the future but at least they can look into the rearview mirror with much greater clarity and see out the side windows of the monetary policy vehicle. This could allow them to create the amount of money and credit necessary to keep the economy growing at a smooth pace more easily than they do today. Switching off the gold standard vastly reduced economic volatility and improved per capita economic growth. Moving to blockchain-enhanced fiat currencies could further reduce economic volatility and, ironically, enable further leveraging of the already highly indebted global economy as people find ways to use capital more efficiently. More broadly, crypto-inspired investments could bring about new technologies that we cannot yet imagine.

Investors who are buying bitcoin are presumably hoping to find someone to sell to at a higher price. That said, there is more to bitcoin economically than just the theory of the greater fool. As more people bid up the price, the difficulty of solving bitcoin’s cryptographic algorithms increases. This in turn is driving up investment in more powerful and faster computing technology of both a traditional integrated circuit and non-traditional variety. Indeed, solving cryptographic problems may be one of the first tests facing quantum computers.

The problem is that investors in bitcoin and its peers are mainly out to make profits and not to finance or subsidize the development of distributed ledgers nor more powerful computers.

- Bitcoin supply is highly inelastic; and as with commodities, inelastic supply increases volatility.

- “Difficulty” of mining bitcoin math problems and its price are in a feedback loop, where “difficulty” is a major driver of price, and price also influences “difficulty”.

- Transaction volume may influence price trends, and rising transaction costs are a risk indicator for bitcoin.